Adverse Selection Is a Concept Best Described as

What is Adverse Selection. The risk associated with selecting stocks in only a few specific companies.

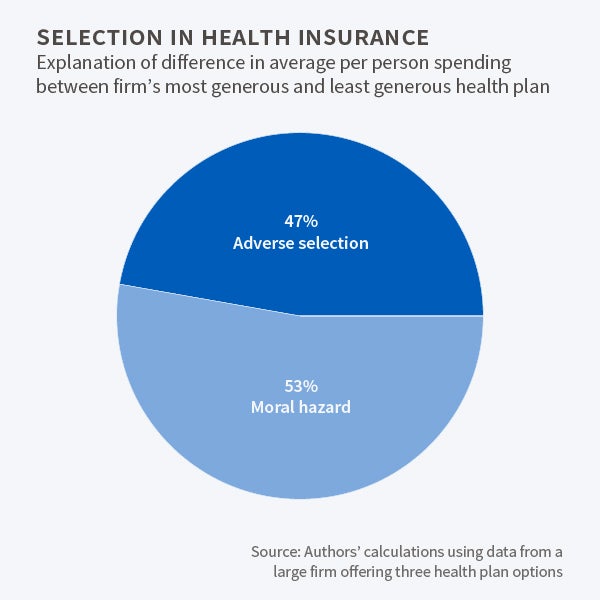

Moral Hazard And Adverse Selection In Health Insurance Nber

A groups reported losses are more likely to become equal to the statistical probability of loss The larger group.

. B Underwriters slanting the odds in favor of the company. This occurs in the event of an asymmetrical flow of information between the insurer and the insured. Access to different information.

The risk that a person will become overconfident in his ability to select stocks. Adverse selection is an economics term means an undesired result happens which the quantity and the price of goods or services altered because of sellers and buyers have different or imperfect market. In economics insurance and risk management adverse selection is a market situation where buyers and sellers have different information.

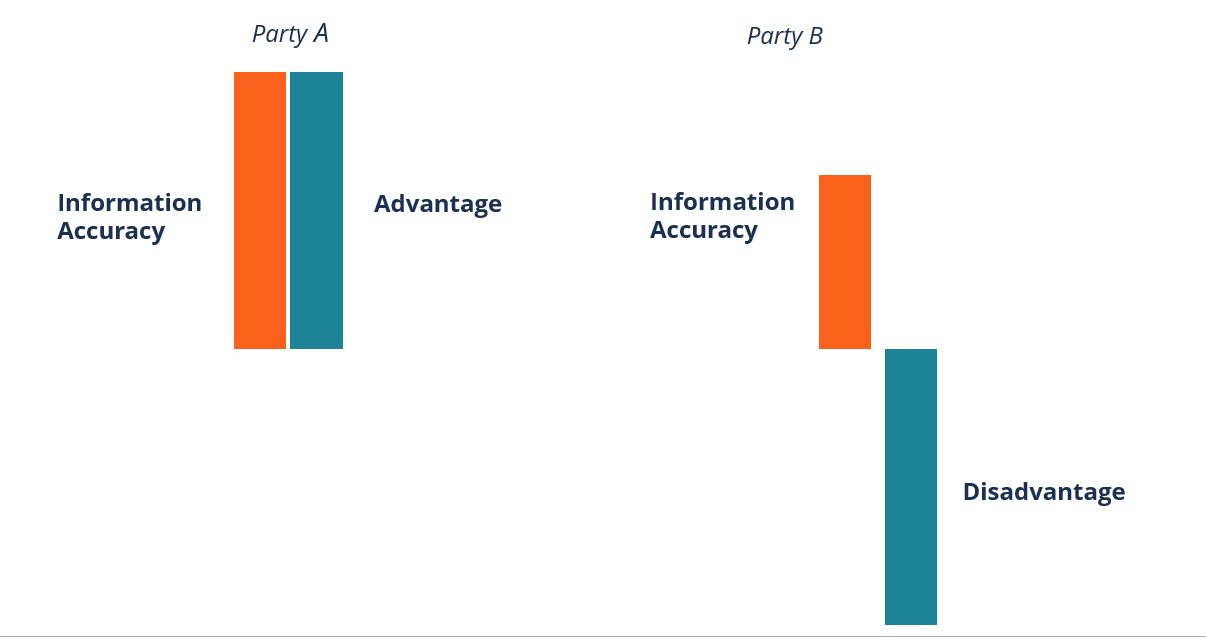

Adverse selection refers to a scenario where either the buyer or the seller has information about an aspect of product quality that the other party does not have. A high - risk person being more likely to apply for insurance. Adverse selection is a concept best described as Risks with higher probability of loss seeking insurance more often than other risks Adverse selection means that there are more risks with higher probability of loss seeking to purchase and maintain insurance than the risks who present lower probability.

Adverse selection is a concept best described as A Risks with higher probability of loss seeking insurance more often than other risks. Adverse selection occurs when the insured deliberately hides certain pertinent. Adverse selection refers to a situation where sellers have more information than buyers have or vice versa about some aspect of product quality.

As described by Dunning there should be an internalization gain in that the firm considers that its ownership advantages are best exploited. Adverse selection is an important concept in the fields of economics as well as insurance and risk management. It refers to a market process in which bad results occur when buyers and sellers have asymmetric information ie.

A textbook example is Akerlofs market for lemons. Adverse selection is most likely to occur in. One such concept is adverse selection which Baliga describes as hidden information Baliga who teaches at the Kellogg School of Management uses the concept to address everything from the war in Iraq to the strategy of terrorism.

Adverse selection anti-selection or negative selection is a term used in economics insurance statistics and risk management. The result is that participants with key information might participate selectively in trades at the expense of other parties who do. Risks with higher probability of loss seeking insurance more often than other risks.

More Nonstandard Auto Insurance. An employer is practicing adverse selection when it has approaches or policies that lead to negative or unfavorable treatment toward a person or a group of people who are in a protected group such as women or minorities. Adverse selection is a phenomenon wherein the insurer is confronted with the probability of loss due to risk not factored in at the time of sale.

Adverse selection also called antiselection term used in economics and insurance to describe a market process in which buyers or sellers of a product or service are able to use their private knowledge of the risk factors involved in the transaction to maximize their outcomes at the expense of the other parties to the transaction. But we can begin to understand how adverse selection works by looking at something as simple as buying a used car. Adverse selection can happen at any point in the employment process such as hiring training promotions transfers and layoffs.

After obtaining insurance a. Adverse selection is a concept best described as. Adverse selection refers to the tendency of high-risk individuals obtaining insurance or when one negotiating party has valuable information another lacks.

Commercial Insurance Broker A commercial insurance broker is an individual tasked with acting as an intermediary between. Refers to market process in which bad results occur due to information asymmetries between buyers and sellers where the bad products or customers are more likely to be selected. Adverse selection is a common scenario in the insurance sector.

Answer 1 of 6. Adverse selection usually refers to a situation where someone cant distinguish between different types of potential customers when they are offering insurance or some other service where the underlying aspects of the users will. Adverse selection refers to an event in which one party in a negotiation has relevant information about the situation that the other party lacks and that asymmetry of information leads to a series of bad decisions or choices such as doing more and more business with less profitable or riskier market segments.

In economics insurance and risk management adverse selection is a market situation where buyers and sellers have different information so that a participant might participate selectively in trades which benefit them the most at the expense of the other trader. Sometimes known as anti-selection Adverse selection describes circumstances in which either buyers or sellers use information that the other group does not have specifically about risk factors related to a particular business. Assignment Point - Solution for Best Assignment Paper.

Adverse Selection Definition How It Works Practical Example

Adverse Selection Definition 3 Examples And 4 Effects Boycewire

Adverse Selection Definition 3 Examples And 4 Effects Boycewire

No comments for "Adverse Selection Is a Concept Best Described as"

Post a Comment